While collaborating with a Data & AI podcast series Let's Talk About Data!, we discovered that hundreds of niche, high-quality Data & AI tools exist across the globe — yet most enterprises are only aware of a handful.

This raised a critical question:

Why are all those strong Data & AI tools invisible to the customer base?

35+

Countries with vendors and increasing

100s

Of niche tools tracked globally

The Visibility Problem

Why startups and smaller vendors rarely qualify for analyst recognition — even when they excel at solving real business problems.

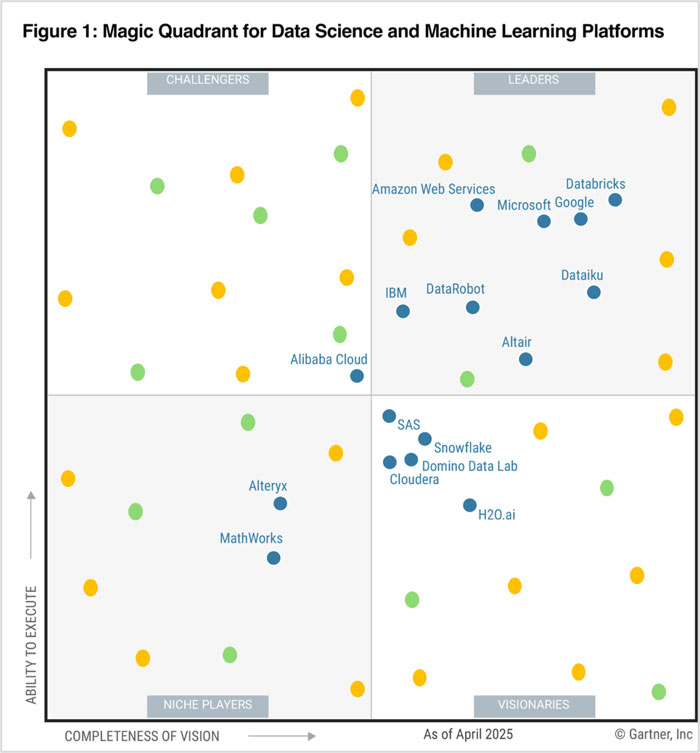

How Gartner Shows

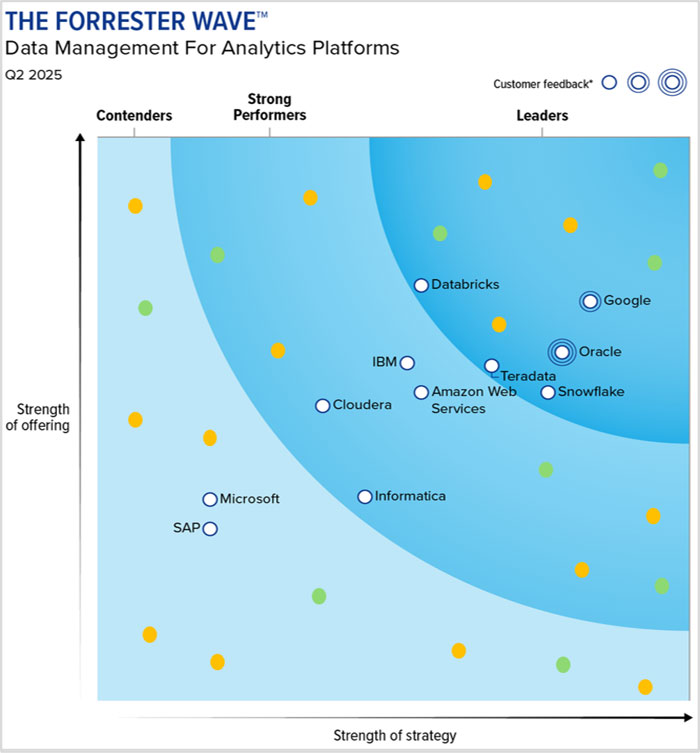

How Forrester Shows

Why?

Gartner & Forrester applies strict eligibility criteria — vendors often need:

- • Minimum enterprise implementations across multiple geographies

- • Revenue thresholds and funding stability

- • Recognition in analyst or customer surveys

- • Broad feature sets, not just single capabilities

This means startups and smaller vendors rarely qualify — even if they excel at solving a real business problem.

What we will make visible!

These companies don't meet Gartner or Forrester eligibility criteria but are often single-feature specialists that solve problems faster and cheaper, staying invisible to enterprise buyers despite being enterprise-ready.

Why Analysts Miss Them

Gartner & Forrester apply strict eligibility criteria:

- Minimum enterprise implementations across multiple geographies

- Revenue thresholds and funding stability

- Broad feature sets, not just single capabilities

- Recognition in analyst or customer surveys

The Consequence

-

Customers default to "Leaders"

And pay for large, complex platforms

-

Only 30-40% of features ever used

But enterprises pay for 100%

-

Smaller vendors with laser-focused solutions

Could solve the pain point at a fraction of the cost — but never make it onto the radar

Our Role

We extend the horizon by making niche, high-quality startups and SME vendors visible:

Pain Points & Resolutions

You're Not Seeing the Full Market — And It's Costing You

Enterprises continue to face three recurring challenges:

High R&D Budgets

Wasted on long discovery cycles

Resolution

Reduce R&D time by rapidly identifying the most relevant tools

Blind Spots

80-90% of niche tools never reach evaluation

Resolution

Provide visibility into the most suitable niche and high-quality tools globally

Overpayments

60-70% extra for underutilized platforms

Resolution

Enable access to tools that deliver high value without unnecessary cost

By bridging this gap, we reduce R&D time, expand visibility into global innovation, and enable access to tools that deliver higher value at lower cost.

Cost of Inaction

When the visibility gap remains unaddressed, enterprises face compounding risks:

Multi-year contracts & proprietary architectures

Restrict flexibility and delay change

Vendor Lock-InCompetitors adopt agile, niche tools

Move faster and innovate ahead while you fall behind

Innovation Lag / Lost Competitive AdvantageOutdated or misfit tools

Create workarounds, manual processes, and costly integrations

Growing Technical DebtOverpaying for mega-vendor solutions

Overbuilt, underutilized, or misaligned with needs

Higher Total Cost of OwnershipClosing this gap isn't optional — it's the difference between keeping pace and falling permanently behind.

The Next Wave of Data & AI Products

Enterprise transformations will not be led by legacy vendors like Oracle, IBM, Microsoft, Informatica, etc.

Rather, they will be driven by Specialized, Agile Technologies

The New Life of a Data Product

Traditional vs New Era — From Months, sometimes, into Minutes/Seconds!

| Phase | Traditional | New Era |

|---|---|---|

| Ideation & Discovery | Business identifies a need, months of research | AI agents autonomously surface needs from patterns — instant inception |

| Design & Assembly | Data models, pipelines, frameworks — weeks to months | Auto-generated pipelines, schema, docs. Assembly drops to hours or minutes |

| Execution & Consumption | Data product goes live — lifespan measured in years | Data product may serve a single query, then retire. Lifespan can be minutes |

| Sunset or Evolution | Decommissioning or upgrades every 1-3 years | Automated retirement or mutation into a new product within seconds |

Why Listen to Us?

Collaboration with podcast series Let's Talk About Data! brings unique, vast knowledge and value from across the globe.

We're not guessing the gap — we've mapped it!

Global Reach

Host of Let's Talk About Data!

80+ episodes, 35+ countries, and growing...

Tool Discovery

Mapped the Market

Tracked 100s of niche & high-quality Data & AI tools globally

Community Influence

Massive Reach

50,000+ direct and 3+ million indirect reach to Data & AI communities

Engage us for a curated discovery pilot

We'd love the opportunity to present a detailed look at what we do — and how we make it happen.

Get in Touch